How Much Money Should I Save Before Buying a House?

When you’re gearing up to buy a house, the first question on your mind is probably, “How much money should I save before buying a house?” The answer can vary depending on a few factors, but a good rule of thumb is to save at least 20% of the home’s purchase price. This not only covers the down payment but also prepares you for closing costs and other unexpected expenses. It’s worth noting that there are numerous programs and assistance options available to help cover these costs, depending on your personal situation and the skill of your real estate agent in finding them.

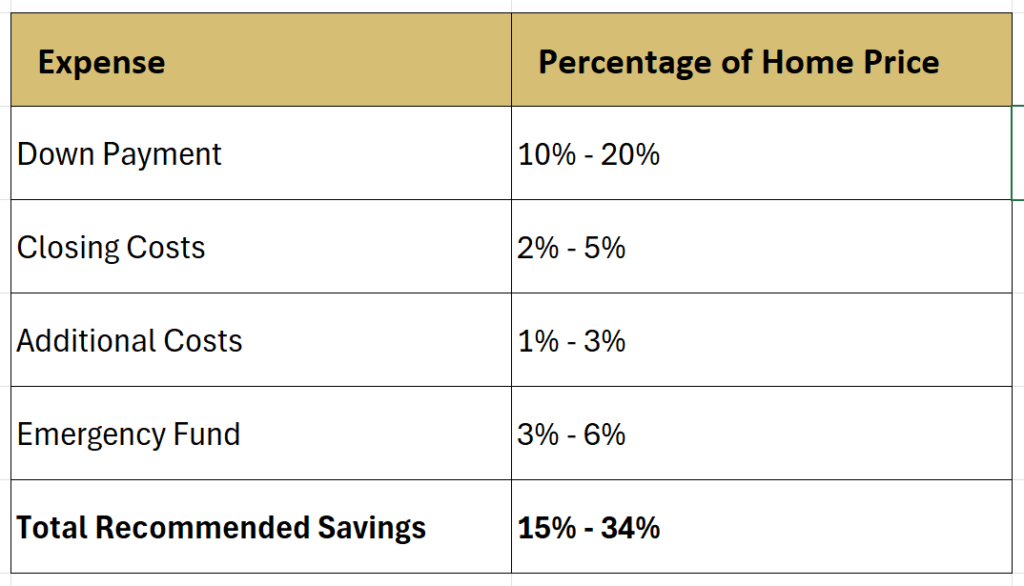

Here's a quick breakdown of what your savings should ideally cover:

For instance, if you’re eyeing a home priced at $300,000, you should aim to save between $45,000 and $102,000. This range ensures you’re not only ready for the initial costs but also equipped to handle any financial surprises along the way.

*The good news is that, fortunately, there are down payment assistance programs that can cover the entire amount. It really depends on your real estate agent and the lender they work with to help you secure this kind of support. Plus, another possible option is negotiating well with the seller—you’d be surprised at what you can achieve!

Find the House Down Payment Calculator on the botton.

Now, let’s dive into the nitty-gritty of how you can achieve these savings and make your homeownership dream a reality!

Understanding Closing Costs and Other Expenses

What Are Closing Costs?

Closing costs can surprise many first-time buyers. These include fees for loan origination, home inspection, and title insurance, usually totaling around 2% to 5% of the purchase price. On a $300,000 home, that’s roughly $6,000 to $15,000. It’s important to budget for these costs to avoid any last-minute financial stress.

Other Essential Costs to Consider

Apart from the down payment and closing costs, there are additional expenses like moving costs, immediate repairs, and buying essential furniture. Setting aside 1% to 3% of the home price can help cover these. It’s also wise to have an emergency fund, separate from your house savings, to handle unexpected situations like job loss or medical emergencies.

The Importance of Building a Good Credit History

A solid credit history is crucial when applying for a mortgage. Lenders look for a good credit score to assess your reliability. Start by paying off existing debts and avoid taking on new ones. Reflecting on my experience, I made it a point to pay off my credit cards and refrain from unnecessary spending. This disciplined approach helped me secure a favorable mortgage rate.

pexels-pixabay-259200

Smart Saving Strategies for First-Time Homebuyers

Cutting Out the Unnecessary Stuff

Saving for a house often means making some lifestyle adjustments. Simple changes, like cooking at home instead of dining out, can significantly boost your savings. During my saving phase, I cut back on daily coffee runs and impulse buys, funneling that money into my savings account instead. It was a small sacrifice that made a big difference in the end.

Setting a Consistent Savings Plan

Consistency is key. Set a fixed amount to save each month and stick to it. Automate your savings if possible, so a portion of your paycheck goes directly into your house fund. This method helped me stay disciplined and consistently grow my savings, even when other financial temptations popped up.

Why You Should Avoid New Debt

Taking on new debt can negatively impact your credit score and debt-to-income ratio, making it harder to qualify for a mortgage. It’s best to avoid new credit card applications or loans in the months leading up to your home purchase. Keeping your financial profile stable shows lenders that you’re a responsible borrower.

Creating an Emergency Fund: Your Safety Net

An emergency fund is your financial safety net, covering unforeseen expenses like car repairs or sudden job loss. Aim to save three to six months’ worth of living expenses. This fund is separate from your house savings and should only be used for genuine emergencies. It’s a crucial step to ensure you’re not caught off guard by life’s surprises.

Long-Term Planning: Budgeting for Ongoing Home Costs

Buying a home is a marathon, not a sprint. It’s essential to plan for ongoing costs like property taxes, homeowners insurance, and maintenance. Budgeting for these expenses will help you maintain your financial health long after the keys are in your hand. Consider future lifestyle changes, like family growth or career moves, when choosing your home and its location.

Practical Tips and Expert Advice

Getting Pre-Approved for a Mortgage

It helps you understand your budget and shows sellers you’re a serious buyer. This step can streamline your home-buying process and give you a clearer picture of what you can afford.

Working with a Real Estate Agent

A knowledgeable agent can guide you through the process and negotiate the best deal. Their expertise can help you navigate the market, find hidden gems, and secure a home that meets your needs and budget.

Choosing the Right Neighborhood

Look into local amenities, school districts, and potential for property value growth. The right neighborhood can significantly enhance your living experience and the long-term value of your investment.

Conclusion: Making Your Homeownership Dream Come True

I hope I’ve answered your question, “How much money should I save before buying a house?” Homeownership is a significant milestone that requires careful planning and saving. By understanding the costs involved and creating a solid savings plan, you can make your dream of owning a home a reality. Remember, every little bit saved brings you closer to your goal. It might mean a few sacrifices now, but the reward of having a place to call your own is priceless.

House Down Payment Calculator

Find out how much you need to save for the Down Payment:

- Choose the loan amount you need (the price of the house you want to buy).

- Select the type of loan you want to get.